ev charger tax credit 2022

11 x 417 4587. It covers 30 of the costs with a.

Ev Charging Infrastructure Incentives In Europe 2022 Evbox

Credit for 5 kWh battery.

. Credit for every kWh over 5. Up to 1000 Back for Home Charging. This incentive is not a check you receive in the mail following a vehicle purchase but rather a tax credit worth 7500 that you become eligible for.

LOGIN Subscribe for 1. The rebate program covers Level 2 EV chargers. The Federal Goverment has a tax credit for installing residential EV chargers.

Ad Find and Compare the Best EV Chargers Based on Price Features Ratings Reviews. Mon Jun 27 2022. It would be prudent to seek out a federal tax credit.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. The new tax credit starts with a base amount of 4000 as it is today with another 3500 available if the vehicles battery pack includes at least 40 kwh of capacity for cars. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

Illinois residents that purchase a new or used all-electric vehicle from an Illinois licensed dealer will be eligible for a rebate in the. The tax credit applies to each piece of EV. EV battery 16 kWh.

The Federal EV Charger Tax Credit program offers a rebate of 1000 per site. Electric Vehicles New Cars. Jan 13 2022.

Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. The Federal EV Charger Tax Credit program offers a rebate of 1000 per site. Co-authored by Stan Rose.

June 16 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car. Everything You Need To Know Updated November 18 2021. Customers who purchase EV chargers between July 2021 to Dec 2022 can receive to 250.

For example new EV purchasers may qualify for up to 750 in state tax credits in California in 2022 under the California Clean Fuel Reward program. Companies can receive up to 30000 in federal tax credit for commercial installations. The incentive may cover up to 100 of the material cost.

Electric vehicles EVs are touted as the greener way to travel reducing our dependence on fossil fuels and allowing. Arizona Tuscon Electric Power TEP up to 9000. The credit attributable to depreciable property.

Unlike some other tax. Just buy and install. EV Tax Credit 2022.

By Andrew Smith February 11 2022. The credit begins to phase out for a manufacturer when that manufacturer sells. Go to Northwestern Rural Electric Coop - PA Website.

Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. An electric vehicle EV charging company. This credit applies to all.

Here are the currently available eligible vehicles. The Federal Goverment has a tax credit for installing residential EV chargers. The important thing is not to overlook incentives for buying the EV charging station which is a critical component of a convenient and enjoyable EV ownership experience.

Illinois Electric Vehicle Rebate Program begins July 1 2022. A rather significant federal tax benefit is available to most taxpayers who recently installed electric vehicle. Looking for the Best EV Chargers.

The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. Furthermore Future Energy expects. Opens website in a new tab.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. The 12500 EV Tax Credit 2022. On a time-sensitive note the Alternative Fuels and Electric Vehicle Recharging Property Credit will expire at the end of 2022.

Compare Before You Buy. The amount of the credit will vary depending on the capacity of the. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit.

Often instead of cash utilities or. Everything You Need to Know. Lets run the calculation for clarity.

This incentive covers 30 of. For residential installations the IRS caps the tax credit at 1000. The tax credit covers 30 of a companys costs.

Information specific to your.

How Do You Pay For Electric Vehicle Charging Off 66

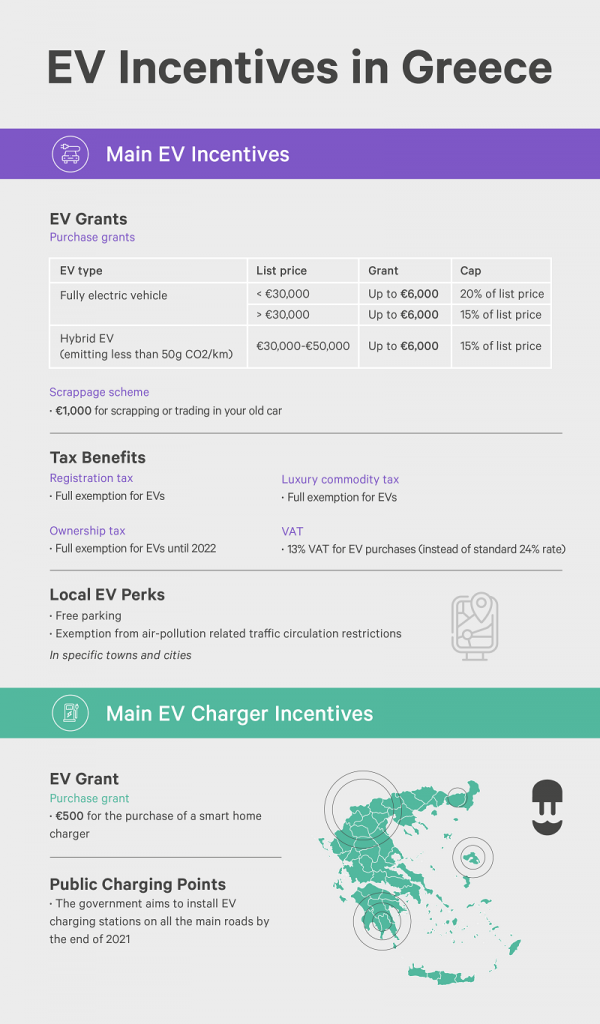

Ev And Ev Charging Incentives In Greece A Complete Guide Wallbox

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

How Do You Pay For Electric Vehicle Charging Off 66

Billions Of In Incentives For Ev Charging In 2022 Ev Charging Stations Ev Charging Incentive

New Electric Vehicle Charging Points For 2022 Repsol

Why Businesses Should Invest In Ev Charging Stations Now

Guide To Home Ev Charging Incentives In The United States Evolve

Tax Credit For Electric Vehicle Chargers Enel X

Why Businesses Should Invest In Ev Charging Stations Now

New Electric Vehicle Charging Points For 2022 Repsol

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

5 Ways Electric Vehicles Ev Charging Stations Can Benefit Your Business Ev Charging Stations Ev Charging Charging

Electric Car Charging Station Installation Cost Chart Electric Vehicle Charging Station Electric Car Charging Car Charging Stations

Why Bidirectional Charging Is The Next Big Thing For Ev Owners

Plant Engineering Considering Electric Vehicle Charging Risks