tax avoidance vs tax evasion vs tax planning

Tax evasion is a felony. Falsifying accounts manipulating accounts overstating expenses understating income and conducting black market transactions are examples of tax evasion.

Difference Between Tax Planning Tax Avoidance And Tax Evasion Income Tax Act Youtube

Tax planning is moral.

. Tax planning and Tax avoidance is legal whereas Tax evasion is illegal. Tax evasion is an intentional. Tax avoidance is an.

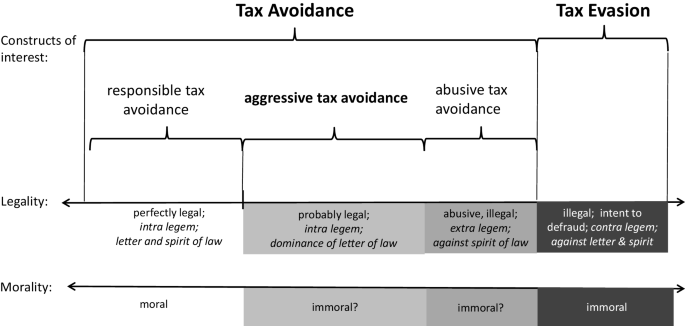

Tax Evasion typically involves deliberately ignoring a specific part of the law. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Tax avoidance is immoral.

Tax avoidance is something the government encourages through tax incentives and credits whereas tax evasion can land someone in court. Tax planning is wider in range. The distinction between evasion and avoidance is largely dependent on the difference in methods of escape resorted to.

Basically tax avoidance is legal while tax evasion is not. When it comes to taxes and the IRS sometimes there is a fine-line between planning to minimize taxes aka legal Tax Avoidance and committing criminal tax. Tax evasion is the use of illegal means to avoid paying your taxes.

Tax evasion occurs when the taxpayer either evades assessment or evades payment. Put simply tax evasion is illegal while tax avoidance is completely legal. Its a compilation of the biggest.

For example those participating in tax evasion may under-report taxable receipts or claim. Tax Evasion vs Tax Avoidance. Each year after tax season ends the IRS reveals a Dirty Dozen list.

Formerly tax avoidance is considered legitimate but with the passage of time tax avoidance is as evil as tax evasion and even attracts penality when discovered. Tax evasion is illegal and. Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the.

Definitions and Differences Tax evasion means concealing income or information from tax authorities and its illegal.

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

The Panama Papers Scandal The Difference Between Tax Avoidance And Tax Evasion Dollar Savvy Blog Sa Capital Advisors

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Aggressive Tax Planning And Corporate Tax Avoidance The Case Study Semantic Scholar

Tax Evasion Tax Avoidance And Tax Planning The Column Of Curae

Tax Planning Tax Avoidance Tax Evasion In Hindi Part 2 Youtube

Aggressive Tax Planning And Corporate Tax Avoidance The Case Study Semantic Scholar

Economics Commerce And Management Short Questions Corporate Tax Planning

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Tax Avoidance Tax Planning Www Thetaxtalk Com

Multinational Enterprises And Corporate Tax Planning A Review Of Literature And Suggestions For A Future Research Agenda Sciencedirect

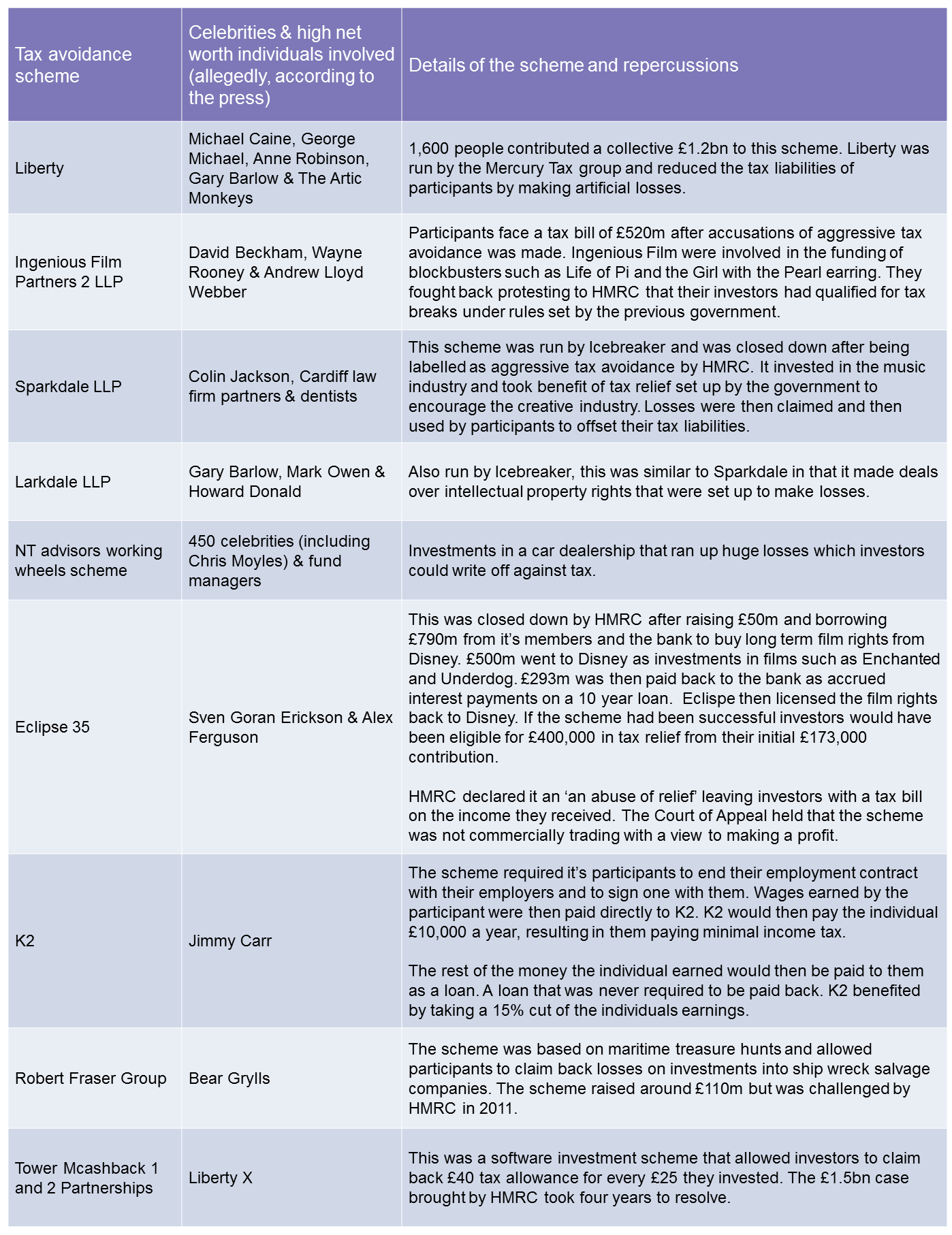

9 Exposed Celebrity Invested Tax Avoidance Schemes

14 Tax Planning Tax Evasion And Tax Avoidance Pdf 14 Tax Planning Tax Evasion And Tax Avoidance Learning Outcomes After Studying This Chapter You Course Hero

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Aggressive Tax Avoidance By Managers Of Multinational Companies As A Violation Of Their Moral Duty To Obey The Law A Kantian Rationale Springerlink

The Board Of Directors And The Corporate Tax Planning Empirical Evidence From Tunisia Semantic Scholar

Difference Between Tax Planning And Tax Evasion L Tax Evasion

Difference Between Tax Evasion And Avoidance Difference Between